Welcome to Mackximus Industrial Real Estate

Mackximus is a local, privately held real estate investment firm focusing on the Southeastern Wisconsin and Chicagoland markets. Mackximus specializes in value-add flex industrial opportunities. With a proven track record, Mackximus continues to grow a “best-in-class” real estate firm rooted in an entrepreneurial and creative spirit.

Our business plan is simple: buy right, lease efficiently, refinance appropriately, repeat.

“The overall objective is to project a lifelong realization that real estate is not a number crunching exercise but is a series of problem solving opportunities which interface practical tools of applied social science with every major issue of our time in terms of the conservation of both our people and our natural resources.“

James A. Graaskamp on Real Estate strategy

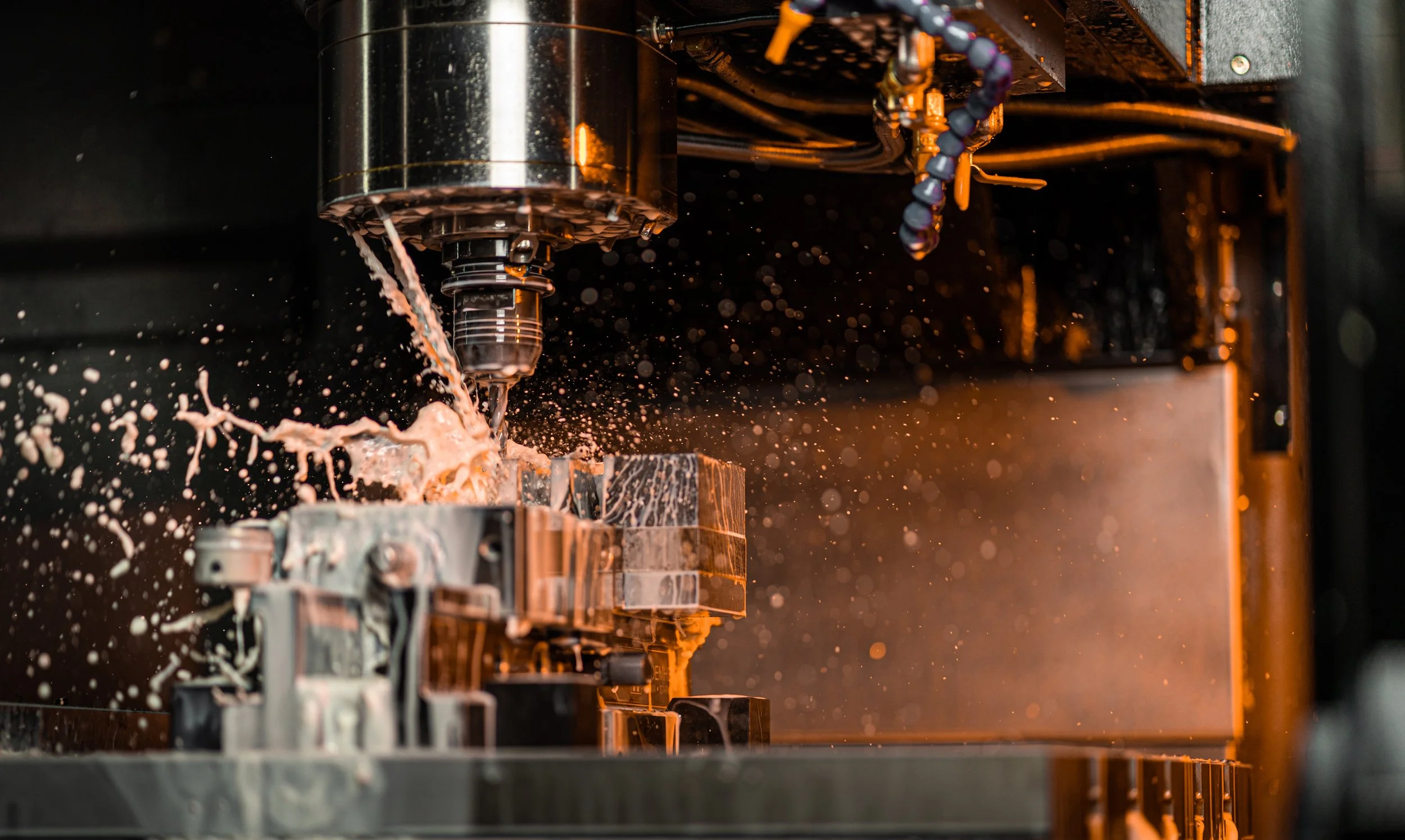

“Industrial real estate has low capital expenditures, low ongoing maintenance, and stable cash flow. I’d much rather own warehouses with CPI increases every year than an office building where significant tenant improvements are needed every time a tenant leaves.”